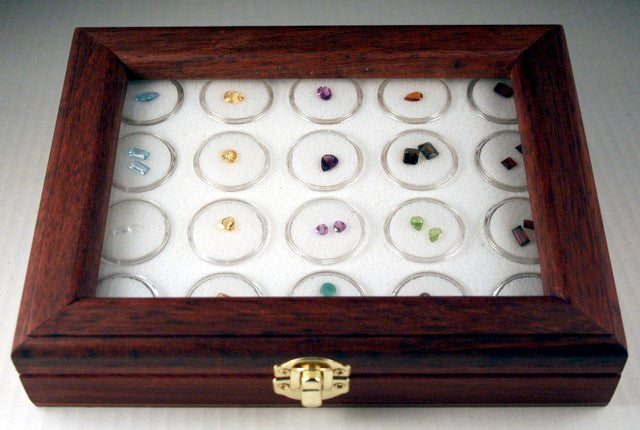

But How Much does the Gem Really Cost? The Illusion of Fixed Prices in a Bargain Culture

How does bartering to secure the price of a gem on location translate to a fixed price at your local store (or on a website!)? Gem pricing depends on two very different systems - how are they linked together in the modern world?

Continue reading