What is Retail and Wholesale Pricing – Really? An Unofficial Opinion

You must have asked yourself this question as well. What (on earth) does it mean when someone tells you that their pricing is wholesale, or retail for that matter? Technically, “wholesale” pricing just means the price charged to a wholesaler (from a manufacturer, for instance), and “retail” pricing means the price charged to retail clients (for example, from a wholesaler). But how much is that?

When you consult web resources for various markup formulas, you will see that how much more you should charge is somewhat subjective. Aside from your production and overhead costs – which can be high if you own a brick and mortar shop - and your expected earnings you also have to look at the competition for your product. As a result, some companies double their total costs, some companies triple them. In the wholesale industry, a markup of twice the total cost is a good average. By contrast, if you are a well established and highly regarded retail outfit, like Cartier or Tiffany’s, you can charge even more than triple – though don’t forget that those companies also offer an exceptional sales experience as well as exceptional and reliable products with a good resale value. When you are the “iddy biddy” neighborhood store or Etsy seller, your markup has to be lower. My jewelry markup is about 2.5 times the production cost, not including overheads or what I pay my assistants (so closer to x2 if that’s figured in). Sometimes it’s less, sometimes a little more. Luckily, I don’t have a brick and mortar store to maintain, so my overhead costs are lower – and I do pass these savings on to the buyer. My production costs are higher however since I do small volume and production is in the United States.

How does markup work in the gem trade? Here’s what I have learned in the past almost 10 years in gem and bead buying.

Wholesalers, by which I am going to mean gem dealers and members of the trade such as the ones that vend at AGTA, GJX and other gem shows, or those who work via internet and phone only, have less than a double markup on average. Unless their gems are specialty cut or one of a kind, your average run of the mill stuff is priced closer to 30-50% up, at least for parcels. For individual gems it can be more since that requires processing (boxing, measuring, making labels, etc). It’s not necessarily much higher, however.

Shot of our friends @primagems at the AGTA Wholesale Show in Vegas. Photo taken from Ganoksin Blog

Retailers, by contrast, have to figure in more customer service such as photos, internet listings, as well as one on one service. And since they are more likely to sell one stone at a time, they have to figure those costs in for each stone, not for a parcel or larger amount. Most of my buyers purchase one stone at a time, a pair, or a few small stones, from my shop – they never buy parcels. That means that I need to process gems by the piece (pretty much), doing measurements and photos for every single stone. At a wholesale show, when I buy from parcels, I do this work as the buyer, not the seller, and I can also buy (and often do) a bunch of gems from the same parcel, which are then weighed and priced together. That is more work for me, but less work for the seller, hence the lower markup.

In short, the difference between wholesale and retail has more to do with the quantity of gems purchased and the labor provided for that quantity. It is less a matter of formula – even less of a matter of whether or not a buyer has tax ID. So when I get a query for a “wholesale” price from a jeweler who wants to get one stone under $100, I am far less likely to provide a discount than I would be for a loyal retail client who has spent thousands in my shop but who is not a wholesaler or jeweler. By the same token, if a retail buyer travels overseas to a gem mining location but intends to only buy a couple of gems , and will only make one purchase, that individual is just as unlikely to get a wholesale price overseas as they would be here. In fact, they are more likely to be ripped off due to inexperience and due to the fact that many less developed countries have no buyer protection.

Prices for gems are also strongly determined by supply and demand. Real estate is the best example for a comparison. The same house, brick for brick, or plank by plank, can cost $50,000 in location A and $500,000 in location B, where the value of the parts is insignificant as a factor in the price difference. Rather, it is that nobody wants to live in location A and everybody wants to live in location B. And when supply of housing is not unlimited (it seldom is), prices go up. In order to determine if one pays too much for a house, or in order to determine what an asking price should be, one studies not the house in isolation but the house compared to other houses like it in the same market.

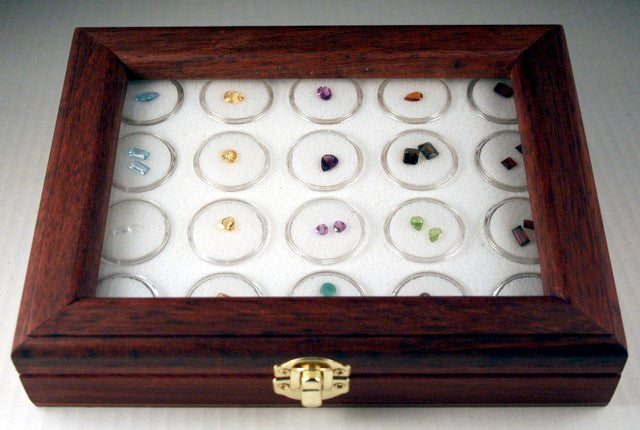

A fun illustration showing the wholesale (large quantity) vs. retail (small quantity) dynamics

It is the same in the gem industry. For some gems, supply really is nearly unlimited (i.e. Brazilian amethyst, white topaz). In those areas prices might just be determined by labor and other overhead costs. For any gem where supply is not unlimited but there is a demand – so exempting rare gems that nobody wants to buy – the price very much depends on how many similar gems there are and how these are priced. In short, gem dealers study the competition for their gems and will price according to what the market will bear. Often that is not as much as one hopes, but at times, it is also rather shockingly high. Cobalt spinel is a case in point. For some rare gems, there is just sufficient demand but almost no supply that the price is just about only a matter between what the seller wants and what the buyer will pay. Large Benitoite is a good example.

Cobalt Spinel from our Etsy shop

Also, prices can fluctuate when an area is mined out but demand is still high (i.e. Mahenge spinel, Mahenge Malaya garnet). Or prices can jump up fast when demand goes up and then level out when it is discovered that supply is not that bad (this is often the case with sapphire). Sometimes prices start out low, then demand increases suddenly and the prices jump drastically, then the market is saturated and prices drop back down (I believe that Grandidierite is an example – I am going to verify this on my next trip to Africa). Sometimes there are government restrictions, civil unrest, a change of government etc, and all this will affect pricing, which can end up being quite volatile when we are looking at small amounts. Current examples are a recent shift in government in Tanzania, export issues in Mogok (affecting ruby and spinel) and export problems with Russia (affecting demantoid).

What should you take away from this? When you shop, study prices on the internet, as best you can, look at gems in person at gem shows or wherever opportunity presents itself, but also work with someone you trust – we all have to do that, not just you as retail buyers but also us in wholesale because you can’t always test everything, and large amounts of money and product have to change hands safely. In the final analysis however, for me it is easiest to work with an educated customer for a smooth and easy transaction. “The more you know…” as they say on TV.